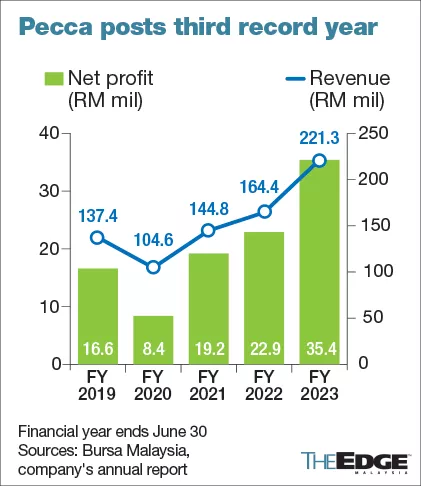

Automotive upholstery maker Pecca Group Bhd posted a record annual profit of RM35.4 million in the financial year ended June 30, 2023 (FY2023), surpassing its previous record annual net profit of RM22.85 million in FY2022. The strong earnings were bolstered by higher sales of car seat covers and improved operational efficiency.

Its earnings per share expanded to 4.71 sen in FY2023, from 3.07 sen per share previously.

The record net profit was on the back of a 34.5% growth in annual revenue to RM221.26 million, against RM164.39 million in FY2022.

Pecca is sitting on a net cash of RM100 million, thanks to its strong earnings growth. The company noted that the large war chest will enable it to accelerate its growth expansion plan.

The company declared a third interim dividend of one sen per share —bringing total dividends to 2.36 sen for FY2023 — payable on Sept 29.

For the fourth quarter ended June 30 (4QFY2023), Pecca’s net profit came in at RM10.08 million, 22% higher against RM8.25 million in the corresponding quarter on higher revenue and improved profit margin.

Pecca’s net profit margin in 4QFY2023 stood at 18.6%, an increase from 16% a year ago. The improvement in profitability was a result of reduced operating costs and enhanced efficiency at the group’s production facilities, in line with Pecca’s strategic focus to optimise the productivity of its manufacturing process.

Quarterly revenue grew 7.05% to RM54.33 million, from RM50.75 million previously, driven by demand for car upholstery, sewing and supply of car accessory covers together with the provision of wrapping and stitching services.

“We are pleased to report another record high quarter of strong financial results, demonstrating our commitment to delivering sustained business growth. Notably, this is the fourth consecutive quarter in fiscal 2023 where Pecca has set a new net profit record,” its chief executive officer Foo Ken Nee said in a statement.

Foo expects demand for high-quality automotive upholstery to remain strong, with its key customer, Perodua, projecting sales and production to hit another record high in 2023, thus, benefiting Pecca in the coming quarter, 1QFY2024.

Additionally, Pecca said the completion of the acquisition of an 80% stake in PT Gemilang Maju Kencana — an Indonesian supplier of upholstery, leather wrapping and seat covers — coupled with the new partnerships with Aero Cabin Solutions SAS (ACS) and Global Component Asia Sdn Bhd (GCA) is expected to help Pecca to penetrate new markets and catalyse its transformation into a multiple engine growth ecosystem.

ACS is a French aircraft interior specialist while GCA is a major maintenance, repair and overhaul (MRO) player in Malaysia.

Going forward, Pecca said it will continue to leverage its key strengths to expand in existing and new markets, with a focus on higher-margin opportunities.

Pecca’s share price gained 0.5 sen to 94 sen, giving the group a market capitalisation of RM707 million. Year-to-date, the stock has climbed 13%.

By The Edge